401k required minimum distribution calculator

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. Roth 401 k contributions allow.

Where Are Those New Rmd Tables For 2022

Under the SECURE Act 20 the shift would be gradual but start quickly.

. Rmd Calculator How To Calculate Ira. Ad Use This Calculator to Determine Your Required Minimum Distribution. Its time to start thinking about RMDs those required minimum distributions that you must take from your retirement plans every year once you.

The distributions are required. Search a wide range of information from across the web here. For example if you turn 72 in October 2022.

New Look At Your Financial Strategy. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

Can You Have Your Own 401k. The first will still have to be taken by April 1. If you were born on June 30 1949 or earlier you were required to begin taking RMDs by April 1 following the year you reached age 70½.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. 1 day agoSep 13 2022 at 1032 am.

How To Calculate Solo 401k Plan Or Individual K Required Minimum Distribution The annual Solo 401k required minimum distribution is calculated by dividing the Solo 401k. Ad If you have a 500000 portfolio download your free copy of this guide now. Amount You Expected to Withdraw This is the budgeted.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Required Minimum Distribution Calculator. 401k Early Withdrawal Calculator.

The SECURE Act of 2019 changed the age that RMDs must begin. This guide may be especially helpful for those with over 500K portfolios. The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and costly mistakes.

Required Minimum Distribution Calculator. Visit The Official Edward Jones Site. The required minimum distribution RMD rules limit the extent to which an individual can use the tax deferral of an IRA or other qualified retirement plan.

Then starting in 2030 it would creep. How to pick 401k investments. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

Depending on your date of birth the IRS requires you to take money out of most types of retirement accounts. A required minimum distribution RMD. Starting in 2023 the age for taking RMDs would jump from 72 to 73.

If you want to customize the colors size and more to better fit your site then pricing starts at just. SECURE Act Raises Age for RMDs from 70½ to 72. The RMD rules apply to all employer sponsored retirement plans including profit-sharing plans 401 k plans 403 b plans and 457 b plans.

The RMD rules also apply to. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The second by December 31.

As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. Ad Find Visit Today and Find More Results. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. Starting the year you turn age 70-12.

These mandatory withdrawals are called required minimum distributions. How Do Rmds Work If You Have More Than One Ira And Do Women Get A Break. Understand how 401k required minimum distributions affect your 401k savings.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Required Minimum Distributions are used to calculate the amount for many retirement plans wherein the person reaches the defined age and shall become eligible to withdraw a minimum. Deadline for receiving required minimum distribution.

The 401k distribution calculator exactly as you see it above is 100 free for you to use. The Setting Every Community. 2022 Retirement RMD Calculator Important.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

/ira_egg-5bfc2f8cc9e77c00519b61a2.jpg)

The Rules On Rmds For Inherited Ira Beneficiaries

How To Calculate Var Finding Value At Risk In Excel

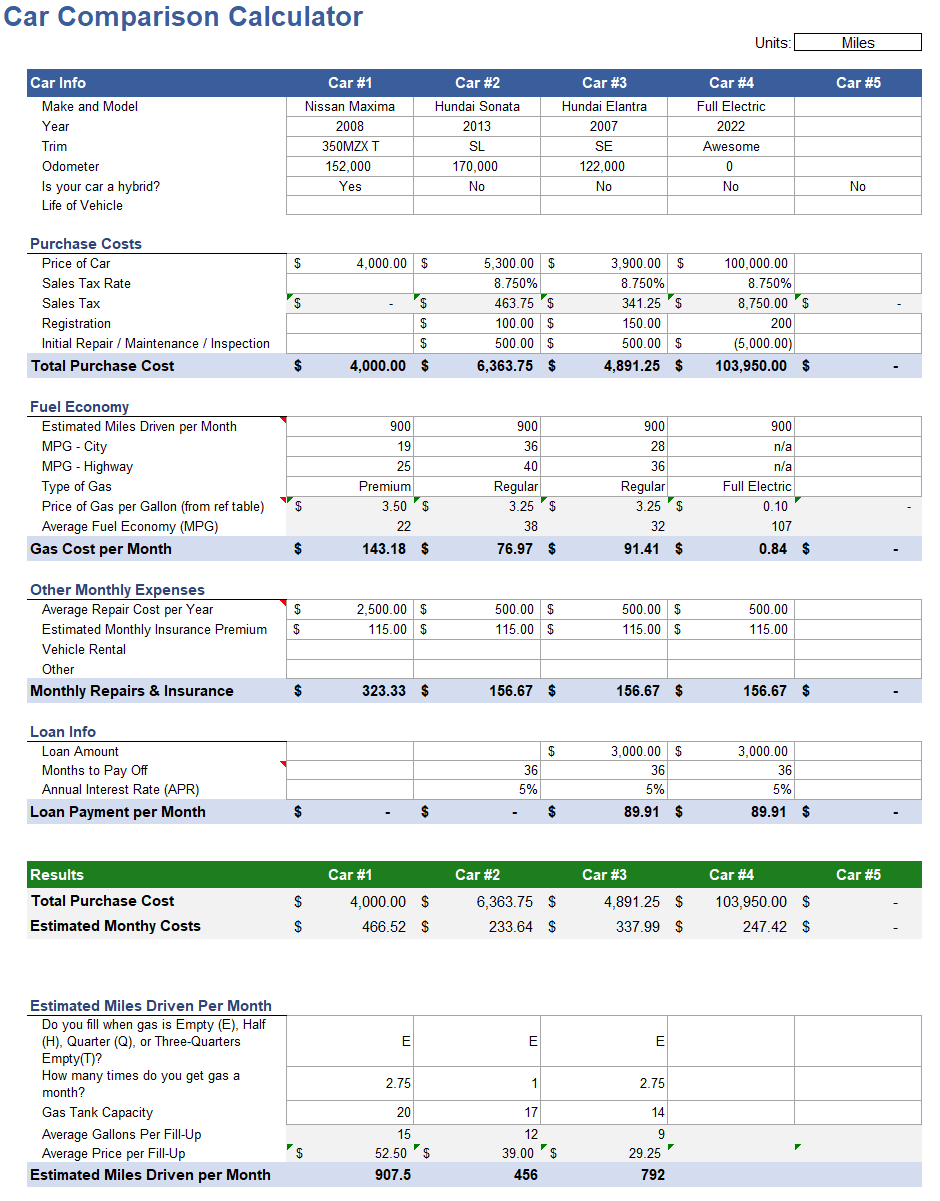

Car Comparison Calculator For Excel

Required Minimum Distribution Rmd Current Year

![]()

Required Minimum Distributions Ameriprise Financial

Your Basic Guide To Rmds The Motley Fool

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Compound Interest Calculator For Excel

The Calculators And Tools Truth Concepts

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Required Minimum Distributions Rmds Youtube

Where Are Those New Rmd Tables For 2022

Required Minimum Distributions Rmds Youtube

Required Minimum Distributions Ameriprise Financial

Required Minimum Distribution Aka Rmd What Is It And Does It Apply To Me Du Charme Financial Group

Required Minimum Distributions What It Is And How To Calculate It Smartasset